Browse Our Website

Navigate the informational pages and resources provided on our official internet presence. This action allows users to explore available products, services, rates, and corporate information.

Navigate the informational pages and resources provided on our official internet presence. This action allows users to explore available products, services, rates, and corporate information.

Initiate the official account opening process. This action directs potential customers to the digital portal required to submit necessary personal information and documentation to establish a formal banking relationship.

Complete the essential security protocol of confirming your electronic mail address. This process validates user identity, secures the account, and activates communication preferences.

Enroll in a specific service, feature, or communication channel (e.g., eStatements, newsletters, premium alerts). This action registers the user for ongoing access to the selected service.

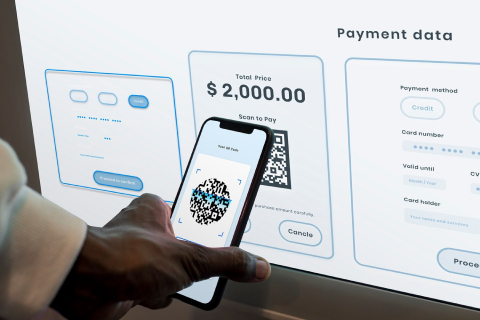

Initiate the financial operation immediately. This action leads the user into the secure workflow required to complete a payment, transfer, or other monetary exchange.

We offer secure services for adding funds to your accounts. This process can be executed through various channels including Cash, Cryptocurrency and Check Deposits at physical branches or ATMs, as well as electronic fund transfers (EFTs) and mobile check capture, ensuring your money is safely stored and accessible.

Our robust platform facilitates all commercial activities, allowing you to seamlessly manage the flow of funds in and out of your accounts. This service provides real-time tracking of all debits, credits, and balance alterations, ensuring complete transparency in your financial operations.

Convenient access to your funds is offered through multiple secure channels, including ATMs, teller services within our branches, and digital banking platforms. This service allows for the secure extraction of cash or electronic transfer of funds from your accounts upon demand.

Avant Bank is a top 50 European bank, and one of the most stable and solvent in Europe. Operating in Spain, Portugal, Ireland, and Luxembourg, it ranks as the fifth-largest bank in Spain, standing out as the most profitable with the highest-quality assets.

Founded in 1965, Avant Bank has grown organically and remained independent, focusing on innovation, exceptional customer service, and cutting-edge technology. It was the first bank in Spain to offer online banking, leading the way in digital banking services ever since.

Avant Bank has once again obtained the best score for Spanish banks and ranked fifth in Europe in the latest stress tests conducted by the European Banking Authority (EBA) and the European Central Bank (ECB). These tests serve to determine the strength of banks in the event of a hypothetical serious economic crisis.

It is also widely recognised for its commitment to sustainability and has been listed in the Dow Jones Sustainability Index for the past seven consecutive years, highlighting its strong environmental, social, and governance (ESG) practices.

As of April 2025, Avant Money is now the Irish branch of Avant Bank, a leading European bank with operations in Spain, Portugal, Luxembourg and Ireland. Becoming the Irish branch of Avant Bank simply means that we are now a bank, which will allow us to introduce a wider range of banking products. We will continue to provide our services online, through brokers and directly through our contact centre here in Ireland.

From April 2025, or shortly afterwards, Avant Bank S.A. will be the controller of your personal data. Your data protection rights, under the GDPR, will continue to be respected as they are today. For further information on how your personal data will be managed, please refer to our privacy policy which can be found at https://avantbank.my.to

1 Click this link: https://avantbank.my.to/forgot-password

2 Enter your email address

3 Check your email and follow the instructions

The core idea is to move customers up through different levels based on their performance as referrers